×

REGISTER

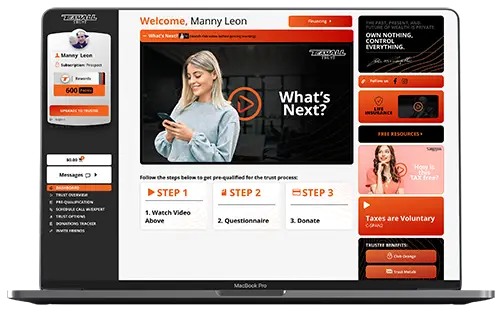

to watch full trust overview

You will also get access to the following:

- Free Resources

- Pre-Qualification Questionnaire

- Schedule a Call with an Expert

- How to get Started

- Access to Rewards Points

- Connect Sneak Peek