Unlock Wealth with Indexed Universal Life Insurance!

Are you ready to take your wealth-building journey to the next level? Today, we’re diving into the world of Indexed Universal Life Insurance (IUL) and why it might be the best-kept secret for growing your wealth!

What is an IUL?

An IUL combines life insurance with the potential for cash value growth linked to a stock market index. This means you can enjoy the benefits of market growth without the risk of losing your principal!

Why Choose IULs Over 401(k)s, Stocks, or IRAs?

Market Growth Potential

Unlike traditional savings accounts or fixed IRAs, IULs allow you to benefit from market upswings.

Tax-Free Withdrawals

Access your cash value tax-free, unlike taxable distributions from 401(k)s or IRAs.

No Contribution Limits

Contribute as much as you want, unlike the contribution limits of 401(k)s and IRAs.

age 35

case study

Creating certainty in an unpredictable financial world.

Are you ready to take your wealth-building journey to the next level? Today, we’re diving into the world of Indexed Universal Life Insurance (IUL) and why it might be the best-kept secret for growing your wealth!

- $112,673 per year in annual tax-free income for 30 years, starting at age 60 (amounting to total distributions of nearly ($3 million)

- Protection for her survivors, starting at $484K and growing to more than $1.7 million

There were other benefits, too – especially in comparison to a traditional retirement plan, such as:

- No required minimum distribution at age 72

- No annual maximum contribution

Plus, if Paige needed any additional funding for her business, the LIRP could allow her to access funds without having to go to a traditional bank or lender.

Money In

$12,000

Annually Paid for 20 years

$12,000

Total Premiums Paid

Money Out

$112,673

Annualized Tax Free Income

$2,929,489

Total Distributions from ages 60-90

Money to Heirs

$484,873

Initial Death Benefit

$1,725,501

Death benefit @ age 90

get a quote

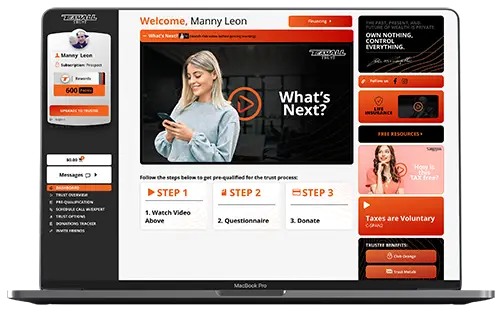

Learn how contributing $250/month to an IUL compares to a 401(k) for different age groups.

Speak to a Team All Insurance Specialist

Disclaimer Notice: The content of this website is provided for educational purposes, omissions and errors excepted, and is not legal/lawful advice.